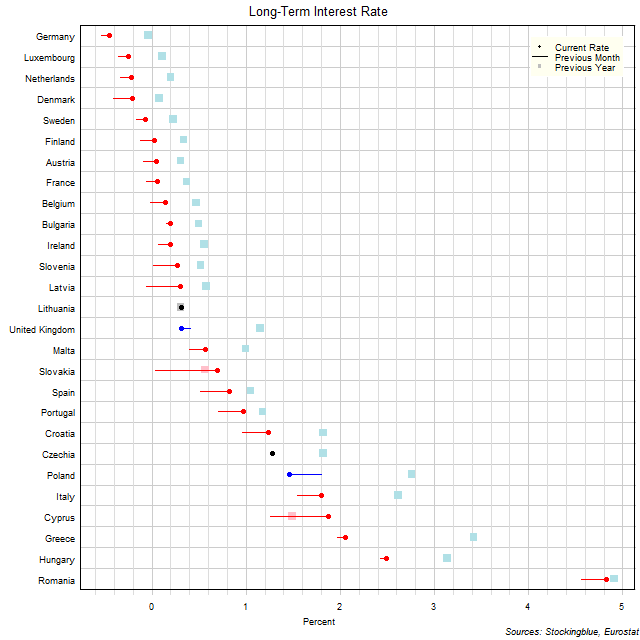

The chart above shows the ten-year interest rate in each EU state as of April 2020, the change from the previous month, and the rate one year prior. Five states have a negative interest rate (down from ten last month and up from one last year).

Findings

- The difference (spread) between the state with the lowest long-term interest rate, Germany, and the state with the highest, Romania, is 5.28 percentage points (up from 5.10 last month and up from 4.95 last year). Germany had the lowest rate last year and last month. Romania had the highest rate last year and last month.

- The median long-term interest rate in the 28 EU states is 0.31 (up from 0.15 the previous month and down from 0.57 last year) and the mean 0.77 (up from 0.60 the previous month and down from 1.17 last year).

- Two states did not see a change in their long-term interest rate from the previous month, two saw their rate decrease, and 23 state saw their rate increase.

- One state did not see a change in its long-term interest rate from last year, 24 saw their rate decrease, and two states saw their rate increase.

Caveats

- Data is from April 2020, March 2020, and April 2019.

- Estonia does not currently issue any sovereign debt that complies with the definition of long-term interest rates for convergence purposes and no suitable proxy indicator has been identified, therefore there is no data available for Estonia.

- All figures are rounded to the nearest hundredth.

Details

Poland saw its rate drop the most over the previous month dropping 0.34 percentage points. On the flip side, Slovakia saw its rate rise the most gaining 0.65 percentage points. Year over year, Greece saw its rate drop the most with a 1.37 percentage point drop while Cyprus saw its rate rise the most gaining 0.38 percentage points.

Bulgaria (from 14th lowest rate to 10th lowest rate) went up four spots over the course of the month. Conversely, Latvia (from 8th to 13th) and Slovakia (from 12th to 17th) dropped the most being bested by five states each.

Over the course of the year, the United Kingdom (from 18th to 14th) rose the most besting four states. On the flip side, Lithuania (from 6th to 14th) was bested by eight states.

For reference, the United States' ten-year note was at 2.53% in April 2019, 0.88% in March 2020, and 0.66% in April 2020, meaning that Slovakia, Spain, Portugal, Croatia, Czechia, Poland, Italy, Cyprus, Greece, Hungary, and Romania have higher rates than the US. Japan's ten-year rate was at -0.04% in April 2019, -0.03% in March 2020, and 0.00% in April 2020 being bested by Germany, Luxembourg, the Netherlands, Denmark, and Sweden.

Data

| State | April 2019 | March 2020 | April 2020 |

|---|---|---|---|

| Austria | 0.31 | -0.09 | 0.05 |

| Belgium | 0.47 | -0.02 | 0.14 |

| Bulgaria | 0.5 | 0.15 | 0.2 |

| Croatia | 1.82 | 0.96 | 1.24 |

| Cyprus | 1.49 | 1.26 | 1.87 |

| Czechia | 1.82 | 1.28 | 1.28 |

| Denmark | 0.08 | -0.41 | -0.21 |

| Finland | 0.34 | -0.12 | 0.03 |

| France | 0.37 | -0.06 | 0.06 |

| Germany | -0.04 | -0.54 | -0.45 |

| Greece | 3.42 | 1.97 | 2.05 |

| Hungary | 3.14 | 2.43 | 2.49 |

| Ireland | 0.56 | 0.07 | 0.2 |

| Italy | 2.62 | 1.55 | 1.8 |

| Latvia | 0.58 | -0.06 | 0.3 |

| Lithuania | 0.31 | 0.31 | 0.31 |

| Luxembourg | 0.11 | -0.36 | -0.25 |

| Malta | 1 | 0.4 | 0.57 |

| Netherlands | 0.2 | -0.33 | -0.22 |

| Poland | 2.76 | 1.8 | 1.46 |

| Portugal | 1.18 | 0.71 | 0.97 |

| Romania | 4.91 | 4.56 | 4.83 |

| Slovakia | 0.57 | 0.04 | 0.69 |

| Slovenia | 0.52 | 0.02 | 0.27 |

| Spain | 1.05 | 0.52 | 0.82 |

| Sweden | 0.23 | -0.17 | -0.07 |

| United Kingdom | 1.15 | 0.41 | 0.31 |

Sources

Eurostat. 2020. "EMU Convergence Criterion Series - Monthly Data." Accessed June 5, 2020. https://appsso.eurostat.ec.europa.eu/nui/show.do?query=BOOKMARK_DS-055774_QID_28C5995E_UID_-3F171EB0&layout=TIME,C,X,0;GEO,L,Y,0;INT_RT,L,Z,0;INDICATORS,C,Z,1;&zSelection=DS-055774INDICATORS,OBS_FLAG;DS-055774INT_RT,MCBY;&rankName1=INDICATORS_1_2_-1_2&rankName2=INT-RT_1_2_-1_2&rankName3=TIME_1_0_0_0&rankName4=GEO_1_2_0_1&sortC=ASC_-1_FIRST&rStp=&cStp=&rDCh=&cDCh=&rDM=true&cDM=true&footnes=false&empty=false&wai=false&time_mode=NONE&time_most_recent=false&lang=EN&cfo=%23%23%23%2C%23%23%23.%23%23%23.

Eurostat. 2020. "Government Bond Yields, Ten Years' Maturity - Monthly Data." Accessed June 5, 2020. https://appsso.eurostat.ec.europa.eu/nui/show.do?query=BOOKMARK_DS-054880_QID_-32EBB249_UID_-3F171EB0&layout=TIME,C,X,0;GEO,L,Y,0;MATURITY,L,Z,0;INDICATORS,C,Z,1;&zSelection=DS-054880INDICATORS,OBS_FLAG;DS-054880MATURITY,Y10;&rankName1=MATURITY_1_2_-1_2&rankName2=INDICATORS_1_2_-1_2&rankName3=TIME_1_0_0_0&rankName4=GEO_1_2_0_1&sortC=ASC_-1_FIRST&rStp=&cStp=&rDCh=&cDCh=&rDM=true&cDM=true&footnes=false&empty=false&wai=false&time_mode=NONE&time_most_recent=false&lang=EN&cfo=%23%23%23%2C%23%23%23.%23%23%23.