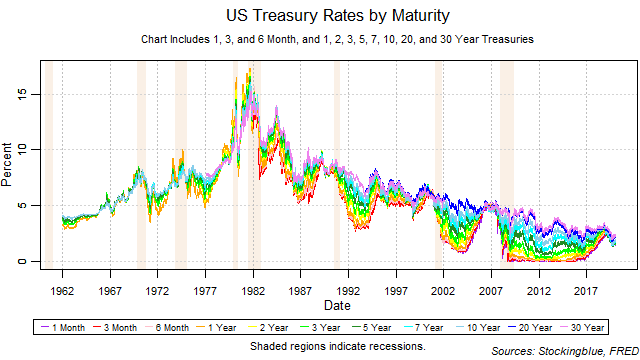

All rates trended downwards following their dramatic turn upwards the previous year after being stuck at zero for several years. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Findings

- All rates dropped in 2019.

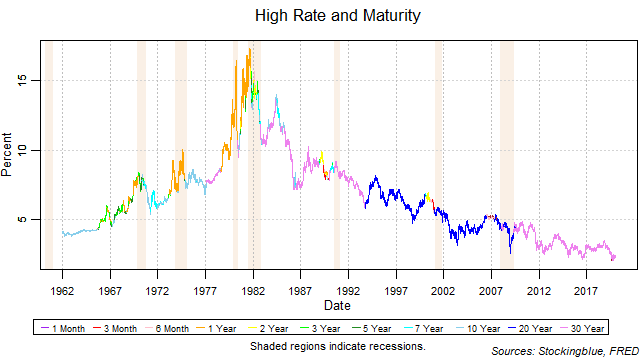

- The 20-year rate saw the smallest absolute drop at 0.62 points.

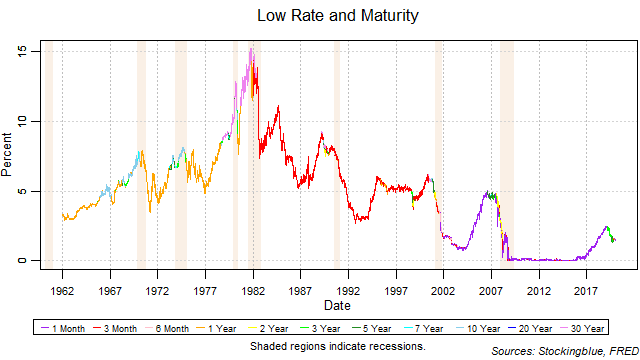

- The one-year rate saw the largest drop at 1.04 points.

- On a relative basis, the 30-year rate dropped the least with a 20.86 percent drop.

- The one-year rate dropped the most on relative terms with a 39.54 percent drop.

- The one-month bill did not maintain the lowest rate throughout the year.

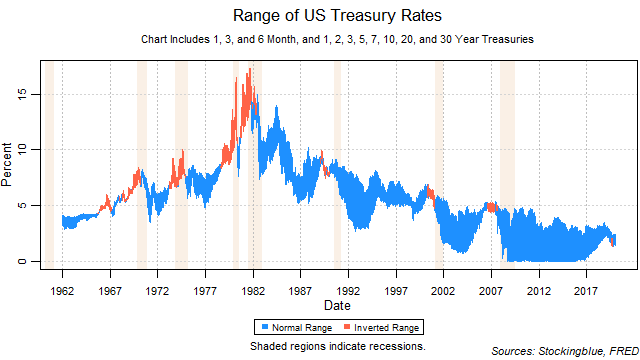

- The yield curve widened 0.33 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve narrowed, inverted for a brief period, and reverted over the year from a range of 0.58 to a range of 0.91. The widest range was 0.91 on December 31 and the most extreme inverted range 0.73 which occurred on September 4.

The thirty-year bond did not hold the highest rate throughout the year, although it has since recovered and has held the highest rate after the yield curve reverted.

The one-month bill had trouble holding the lowest rate for a good chunk of the year. It too has since recovered and has held the lowest rate more frequently at the end of the year.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed January 7, 2020, https://fred.stlouisfed.org/categories/115.